About Us

GPA Overview

GPA is a real estate investment organization that focuses on office properties in the United States.

The Federal Government is one of the largest real estate players in the United States, owning or leasing a huge portfolio of office buildings and other real estate assets across the country.

The Public Building Service (“PBS”), a major division of the General Services Administration (“GSA”), is specifically tasked with providing workplaces for over 1.4 million Federal employees, as well as with the development, leasing and disposition of Federal property.

Our Features

Investment Property Features

Target Properties Under Long-term Lease

U.S. government occupied office buildings under long-term non-cancellable leases exhibit many of the characteristics of traditional government securities.

Target properties feature:

Unparalleled Credit Quality Tenants

Leases signed by the U.S. Government’s General Services Administration (“GSA”) are backed by the full faith and credit of the U.S. Government just like U.S. Treasury Bonds.

Favorable Lease Renewal Experience

Properties leased to the GSA typically relet to the same agency or another government agency (92% of the time).

Growth Potential

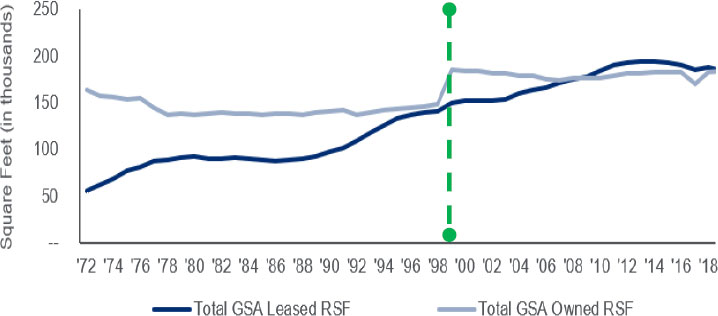

During the past 40 years, the amount of GSA leased space has increased from approximately 46M SF to approximately 178M SF.

Our Strategy

Business Strategy

Our Market

Attractive Market Opportunity

Favorable Market trends

GSA-leased inventory has grown 23.3% since 1998 (as compared to a 1.1% decline for GSA GSA-owned), and the GSA now rents more than it owns.

Given recent federal budget constraints, we believe it is likely that the U.S. Government will continue to grow its leased portfolio of assets.

Highest quality credit tenant along with low interest rate environment creates opportunity for favorable risk adjusted return.

High Barriers to Entry

Knowledge of GSA procurement process, protocols and culture.

Understanding of mission and hierarchy of tenant agencies.

Proven experience in managing GSA assets.

Access to capital.

Deal Overview

Overview of a Typical Deal Characteristics

Deal Size

$70 -$250 million

Tenant

U.S. Government

Location

Growing markets, strategic locations to facilitate the tenant agency's mission

Agency

Mission Critical facilities (Such as: VA Outpatient , Social security, FBI headquarters, SBA etc.)

Lease term

Initial lease terms of 8 to 20 years, non-cancelable

GP - LP

10% - 90%

LTV

60% - 65%

Cash On Cash

9% - 12%

Our Services

What We Offer

We will locate the correct buildings that already have 10 -15 years min left on the lease term.

We will negotiate the deals with the seller to be able to get a min of 6% cap or more.

We have the experience to do the management on the property.

We have the experience in negotiating with the GSA to renew the leases.

Portfolio

Our Gallery

GPA’s Investment Program generates attractive risk adjusted returns given current market dynamics.

Get a Quote

Contact Us

Our Address

1488 Deer Park Ave suite 372 North Babylon, NY 11703